All Categories

Featured

Table of Contents

Keeping all of these phrases and insurance kinds straight can be a migraine. The complying with table puts them side-by-side so you can quickly set apart among them if you obtain confused. An additional insurance policy coverage kind that can pay off your home loan if you die is a common life insurance plan

A is in area for a set number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away throughout that term. A provides insurance coverage for your whole life span and pays out when you pass away.

One usual guideline is to go for a life insurance coverage plan that will pay out approximately 10 times the insurance holder's wage amount. Alternatively, you could pick to use something like the penny method, which adds a family members's financial debt, income, mortgage and education and learning expenditures to calculate how much life insurance policy is required (what is mortgage insurance).

It's likewise worth noting that there are age-related limits and thresholds enforced by almost all insurance providers, who often won't offer older buyers as many choices, will certainly charge them a lot more or may refute them outright.

Here's how mortgage defense insurance coverage gauges up versus standard life insurance policy. If you're able to qualify for term life insurance coverage, you ought to stay clear of mortgage security insurance policy (MPI).

In those scenarios, MPI can provide excellent satisfaction. Just make certain to comparison-shop and check out every one of the small print prior to enrolling in any type of plan. Every home mortgage security option will certainly have many policies, guidelines, benefit options and downsides that need to be weighed carefully against your exact situation (do you have to have life insurance to get a mortgage).

Mortgage Protection Insurance Disability

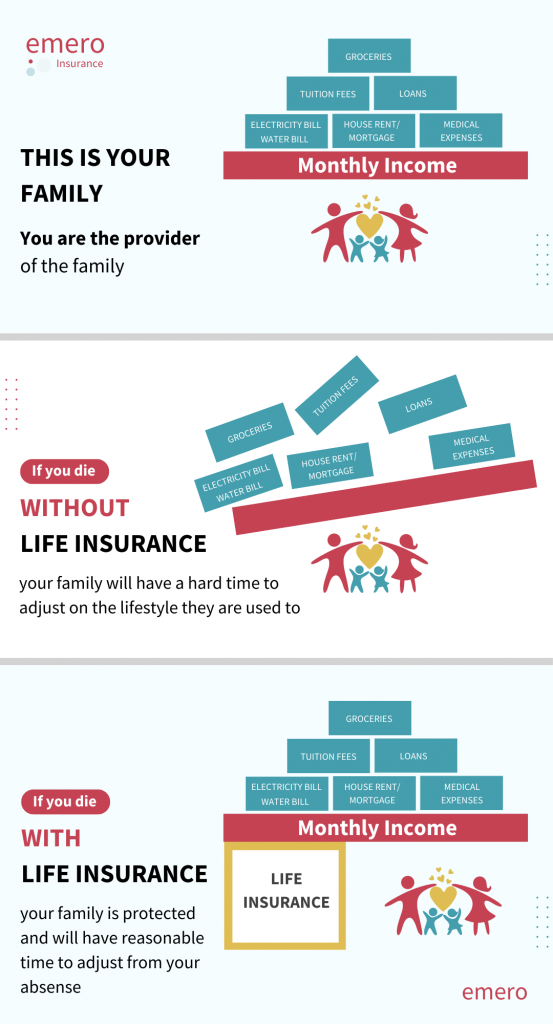

A life insurance policy can help repay your home's home mortgage if you were to pass away. It is among several manner ins which life insurance may aid shield your liked ones and their financial future. One of the most effective methods to factor your home loan right into your life insurance requirement is to speak with your insurance coverage agent.

As opposed to a one-size-fits-all life insurance coverage plan, American Domesticity Insurance coverage Firm offers policies that can be created especially to satisfy your family members's demands. Here are a few of your alternatives: A term life insurance plan. mortgage payment protection insurance wells fargo is active for a certain amount of time and generally provides a bigger amount of insurance coverage at a reduced rate than an irreversible policy

Instead than just covering a set number of years, it can cover you for your whole life. It additionally has living advantages, such as money value build-up. * American Family Members Life Insurance Business uses different life insurance policies.

They might likewise be able to help you locate voids in your life insurance policy coverage or new ways to save on your other insurance policies. A life insurance recipient can pick to utilize the death advantage for anything.

Life insurance policy is one way of assisting your household in paying off a mortgage if you were to pass away before the mortgage is totally repaid. Life insurance profits might be used to assist pay off a mortgage, however it is not the same as home mortgage insurance policy that you could be called for to have as a condition of a financing.

Private Mortgage Insurance Policy

Life insurance coverage may assist guarantee your residence stays in your household by supplying a death advantage that might help pay down a home mortgage or make essential acquisitions if you were to pass away. This is a quick summary of coverage and is subject to policy and/or motorcyclist terms and conditions, which may vary by state.

Words lifetime, long-lasting and permanent go through policy terms. * Any loans extracted from your life insurance policy policy will certainly accrue rate of interest. mortgage insurer. Any superior financing balance (lending plus interest) will be subtracted from the death advantage at the time of claim or from the cash money worth at the time of surrender

** Subject to policy conditions. ***Discount rates might vary by state and firm underwriting the auto or homeowners policy. Discount rates might not put on all insurance coverages on an auto or property owners policy. Price cuts do not use to the life plan. Plan Kinds: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

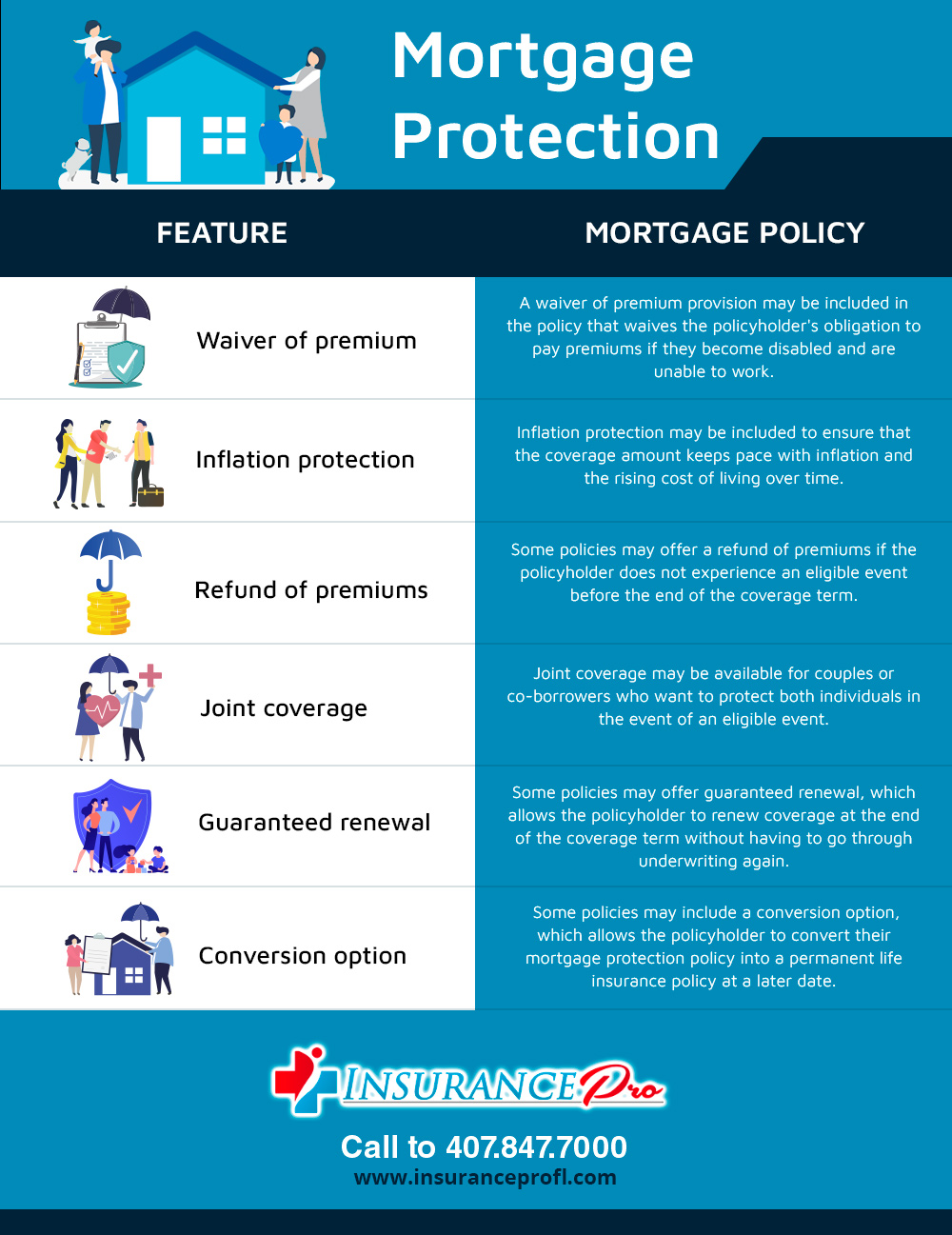

Home mortgage security insurance (MPI) is a different sort of safeguard that can be useful if you're incapable to repay your home loan. While that added security sounds great, MPI isn't for every person. Here's when home loan protection insurance policy deserves it. Home loan protection insurance policy is an insurance plan that pays off the rest of your home loan if you die or if you end up being impaired and can't function.

Both PMI and MIP are needed insurance policy protections. The amount you'll pay for home loan defense insurance coverage depends on a selection of factors, consisting of the insurance company and the existing equilibrium of your home loan.

Still, there are benefits and drawbacks: A lot of MPI policies are provided on a "guaranteed acceptance" basis. That can be advantageous if you have a health and wellness problem and pay high prices for life insurance policy or struggle to obtain insurance coverage. insurance and loan. An MPI plan can provide you and your household with a complacency

Decreasing Insurance Life Mortgage Term

It can likewise be handy for individuals who do not qualify for or can not pay for a traditional life insurance plan. You can pick whether you require mortgage defense insurance coverage and for exactly how lengthy you need it. The terms usually vary from 10 to 30 years. You may desire your mortgage security insurance term to be close in size to how much time you have entrusted to pay off your home loan You can terminate a home loan defense insurance coverage.

Latest Posts

Funeral Costs Calculator

Instant Life Insurance Coverage

About Burial Insurance